Till the day we all usually do not start earning, i continue questioning why all play around regarding tax protecting. But the second we have all of our earliest income and watch the newest quantity of income tax becoming cut, i understand the significance of effective income tax thought.

Indian income tax laws offer loads of opportunities to remove their taxable income. not, extremely taxpayers learn and take benefit of ? step 1.5 lakh deduction available lower than Part 80C.

But really, we all are not able to benefit from all the tax saving avenues readily available of us. Mainly we prevent once stating deduction around Point 80C, generally due to decreased awareness regarding other choices.

Although not, by once you understand on a number of other income tax-saving ventures that are offered, all taxpayer can after that reduce the taxation they pay. On this page, we are number ten ways that will help you to help save tax except that 80C.

1) Tax saving with NPS under Part 80CCD(1B) + 80CCD(1):

Each year, you can claim an excellent deduction upto Rs step 1.5 lakh lower than Area 80C because of the contributing payday loans Grayson Valley to the National Pension Program (NPS). Besides this, you could claim a supplementary deduction less than Section 80CCD (1B) of the contributing a separate Rs 50,000. This means, for folks who fall into the newest 30 % income tax bracket, you might decrease your taxation matter because of the Rs 15,600 of the investing in NPS. The latest 4 per cent educational cess is even integrated within this.

2) Tax offers into the Medical insurance premium under Point 80D:

To help you remind care about-funded medical health insurance, there’s a taxation bonus. Point 80D enables taxation write-offs on the full nonexempt income toward percentage out-of health insurance advanced in addition to expenditures sustained into medical care. Perform look at the coverage document to ascertain if premiums purchased they qualify for income tax deduction below Point 80D.New restrictions to help you claim tax deduction below Section 80D utilizes which are typical incorporated in health insurance protection and their decades. And that, with respect to the taxpayer’s family unit members condition, new maximum might be ? 25,000, ? fifty,000, ? 75,000, otherwise ? 1 lakh.

If your health coverage covers your instant nearest and dearest and not parents, then you may claim up to Rs 25,000 into the premium paid. If the policy talks about an individual who is over age away from sixty, then your limitation you could potentially allege are Rs fifty,000. Besides, when you have pulled any plan for your mother and father, then the superior for non-seniors was Rs twenty five,000. As well as for seniors, it is Rs 50000. That is past all your family members defense restriction.

3) Taxation coupons towards payment of a studies financing lower than Point 80E:

Borrowing from the bank to realize advanced schooling fantasies is common now. Youngsters who possess availed a training financing to follow their education are offered an income tax work for toward installment of your desire component of the loan significantly less than Part 80E. It taxation work with should be stated from the sometimes this new parent or the infant (student), dependent on just who repays the education loan first off stating it deduction.

It taxation deduction is additionally readily available just towards bringing a training mortgage out of associations and never out-of family relations otherwise members of the family and you can members of the family. Taxpayers can also be allege the fresh new deduction from the season they start paying down the eye towards the education loan plus the brand new eight quickly thriving monetary decades otherwise before focus is paid-in full, any kind of are prior to. There’s no restrict into the deduction reported on the attention payment.

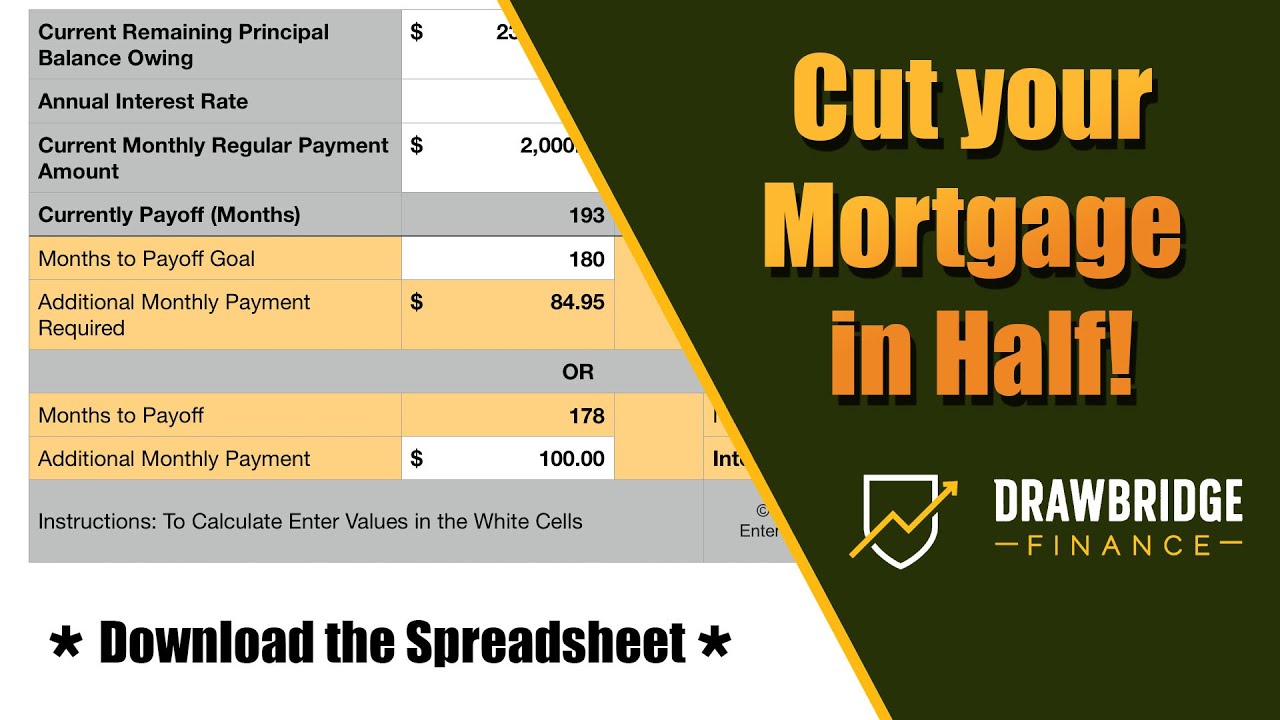

4) Income tax discounts towards the Notice element of Financial under Point 24:

Residents that have home financing normally claim tax deduction around Point 24 of one’s taxation with the attract element of its mortgage. The most tax deduction that a good taxpayer can get right here on the interest fee from mortgage removed to own a self-filled property is ? 2 lakhs.If your possessions by which your house mortgage could have been drawn is not self-filled that is leased otherwise deemed getting leased, no restriction restriction having income tax deduction could have been given, so when a good taxpayer, you can just take an effective deduction overall attention amount below Part 24.However in instances when the new borrower (homeowner) neglects so you’re able to inhabit the property due to work, business or occupation proceeded any kind of time other put, pushing them to live any kind of time most other set; the degree of taxation deduction readily available significantly less than Area 24 is bound in order to ? dos lakhs.